2023 Q3 Automotive Aftermarket Trends

Both US & Canadian consumers have been challenged in 2023 with employment, wages, inflation, interest rates, and uncertainty. In a comprehensive study conducted by In Motion Brands (IMB), a leading authority in the automotive aftermarket, data and analytics from Q3 were thoroughly examined to uncover valuable insights for the past quarter and upcoming fall season. The focus was primarily on top keyword Google search volumes related to auto repair and tires in both the USA and Canada.

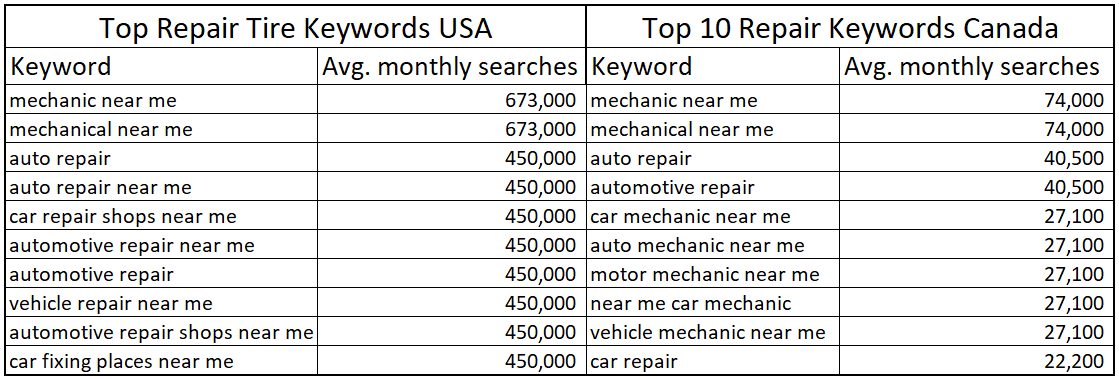

Auto Repair-Related Keywords:

In the US, IMB identified 1,456 auto repair-related search terms, of which the top 80%, comprising 89 keywords, exhibited a remarkable year-over-year growth of 16%. Conversely, Canada displayed a surge of 42% in the top 80% of auto repair keywords, totalling 102 out of 1,409 identified search terms.

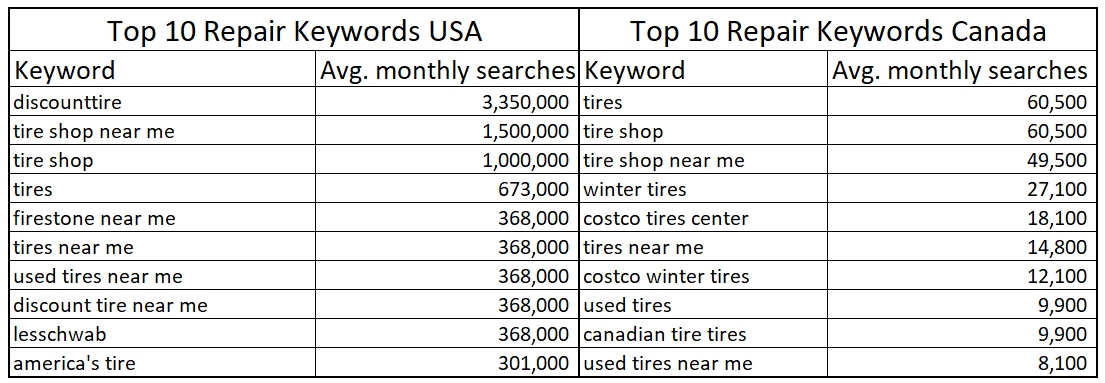

Tire-Related Keywords:

tire-related keywords in the USA experienced an average of 16,762,400 monthly searches, with the top 80% (203 keywords) demonstrating a 7% year-over-year growth. There were 1,190,592* monthly searches in Canada, with 252 keywords comprising the top 80%, exhibiting a substantial 15% year-over-year growth.

Key Insights and Implications:

The study revealed intriguing trends, suggesting potential explanations:

Consumer Behavior Disparities:

Canadians seem more inclined towards extending the life of their vehicles, possibly driven by economic factors, as evidenced by the high growth in auto repair searches. Additionally, Canadians may have a higher inclination for digital consumption than their American counterparts. The data also suggests the American population continues to engage in self-repair and maintenance activities (Do it Yourself / DIY Market)

Regardless of the assumptions made about consumer behaviour, it is clear the economic challenges impacting consumer confidence on both sides of the border is having a positive impact on the Automotive Aftermarket. The data collected by IMB supports this outlook.

IMB reports that year-over-year search volume for “buy a new car” is down 19% both on a three and twelve month average. These findings support a bullish outlook on the Aftermarket performance.

Seasonal Predictions:

IMB’s analysis of winter tire search volume in Canada indicated a substantial year-over-year increase of 10%. This trend suggests a strong potential for significant growth in winter tire sales, contingent on favourable winter weather conditions.

How do these favourable consumer behaviours and the related digital trends impact independent tire and automotive repair businesses?

To bring factual data to assist decision-makers within the Industry, IMB aggregated all the online search data reported in Google Analytics for all Automotive Aftermarket (AA) clients across North America.

The total number of conversions** was combined only for those AA clients with YOY data to compare.

Although consumer interest online was up across both major AA segments at an average increase of 20%, conversions for IMB AA Partners were up 215%, more than double, in Q3. This is the second consecutive quarter in which conversions have doubled for IMB AA Partners.

Conclusion:

Todd Richardson, CEO of In Motion Brands, highlighted the significance of these findings, indicating that broader economic trends and consumer behaviours strongly influence the Automotive Aftermarket demand. With a proactive approach, businesses can understand why they need to leverage these insights to adapt their digital strategies to evolving consumer needs.

Study conducted by In Motion Brands (IMB) – October 2023.

*Please note Canada Tire was removed from the data

**Conversions measured included: sales, phone calls, form submissions, booked appointments, and email requests.